Working Capital Management, the Importance!

Accounting Wise has completed a project on Working Capital Management for a client with a turnover of £90 million. The project resulted in the introduction of a Working Capital System that achieves an increased cash inflow position of £5.5 million on a year on year basis. This is a huge increase to the clients cash position and will drastically help decrease their costs around borrowing. Contact us on 0330 113 8442 to arrange a consultation on how we could potentially improve the efficiency of your business.

What is Working Capital?

Proper management of working capital is essential to a company’s fundamental financial health and operational success as a business. A hallmark of good business management is the ability to utilize working capital management to maintain a solid balance between growth, profitability and liquidity.

What is it Used for?

A business uses working capital in its daily operations; working capital is the difference between a business’s current assets and current liabilities or debts. Working capital serves as a metric for how efficiently a company is operating and how financially stable it is in the short-term. The working capital ratio, which divides current assets by current liabilities, indicates whether a company has adequate cash flow to cover short-term debts and expenses.

The Importance of Working Capital

Working capital is a daily necessity for businesses, as they require a regular amount of cash to make routine payments, cover unexpected costs, and purchase basic materials used in the production of goods. Working capital is an easily understandable concept, as it is linked to an individual’s cost of living and, thus, can be understood in a more personal way. Individuals need to collect the money that they are owed and maintain a certain amount on a daily basis to cover day-to-day expenses, bills and other regular expenditures.

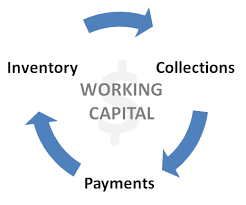

Working capital is a prevalent metric for the efficiency, liquidity and overall health of a company. It is a reflection of the results of various company activities, including revenue collection, debt management, inventory management and payments to suppliers. This is because it includes inventory, accounts payable and receivable, cash, portions of debt due within the period of a year and other short-term accounts.

The needs for working capital vary from industry to industry, and they can even vary among similar companies. This is due to several factors, including differences in collection and payment policies, the timing of asset purchases, the likelihood of a company writing off some of its past-due accounts receivable, and in some instances, capital-raising efforts a company is undertaking.

The Importance of Working Capital Management

When a company does not have enough working capital to cover its obligations, financial insolvency can result and lead to legal troubles, liquidation of assets and potential bankruptcy. Thus, it is vital to all businesses to have adequate management of working capital.

Working capital management is essentially an accounting strategy with a focus on the maintenance of a sufficient balance between a company’s current assets and liabilities. An effective working capital management system helps businesses not only cover their financial obligations but also boost their earnings.

Managing working capital means managing inventories, cash, accounts payable and accounts receivable. An efficient working capital management system often uses key performance ratios, such as the working capital ratio, the inventory turnover ratio and the collection ratio, to help identify areas that require focus in order to maintain liquidity and profitability.

Check out the Accounting Wise services to see ways that we could help you improve your Working Capital Management.